Reflect Credit Card

Your banking journey continues with Reflect

Open your account and apply for a credit card within 24 hours! Have control & boost your funds with Reflect’s hassle-free Visa Platinum Credit Card. No salary transfer and no paper work needed.

Benefits:

✓ 3% cashback on all transactions (Except for Bill Payment or Top Up), capped at 35 JOD/month

✓ Freeze/unfreeze the card online through the application

✓ Schedule instant payments

✓ Adjust your payment option through the app

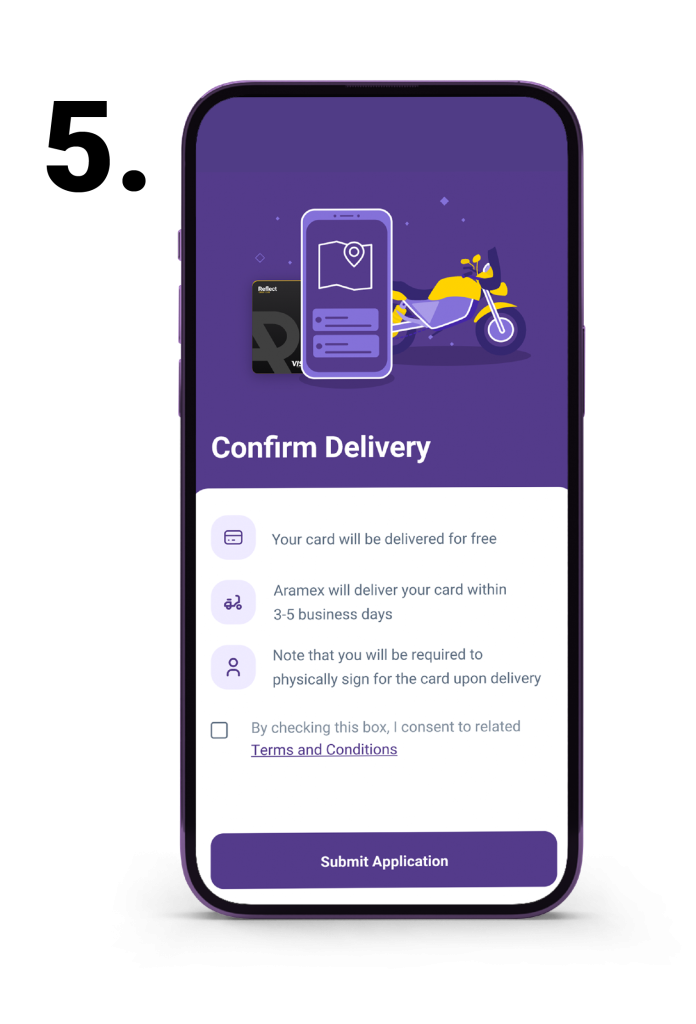

✓ The card can be ordered from the app, and will be delivered to your doorstep

✓ Easy payment plan up to 24 months with 0% interest at selected merchant stores

What makes you eligible?

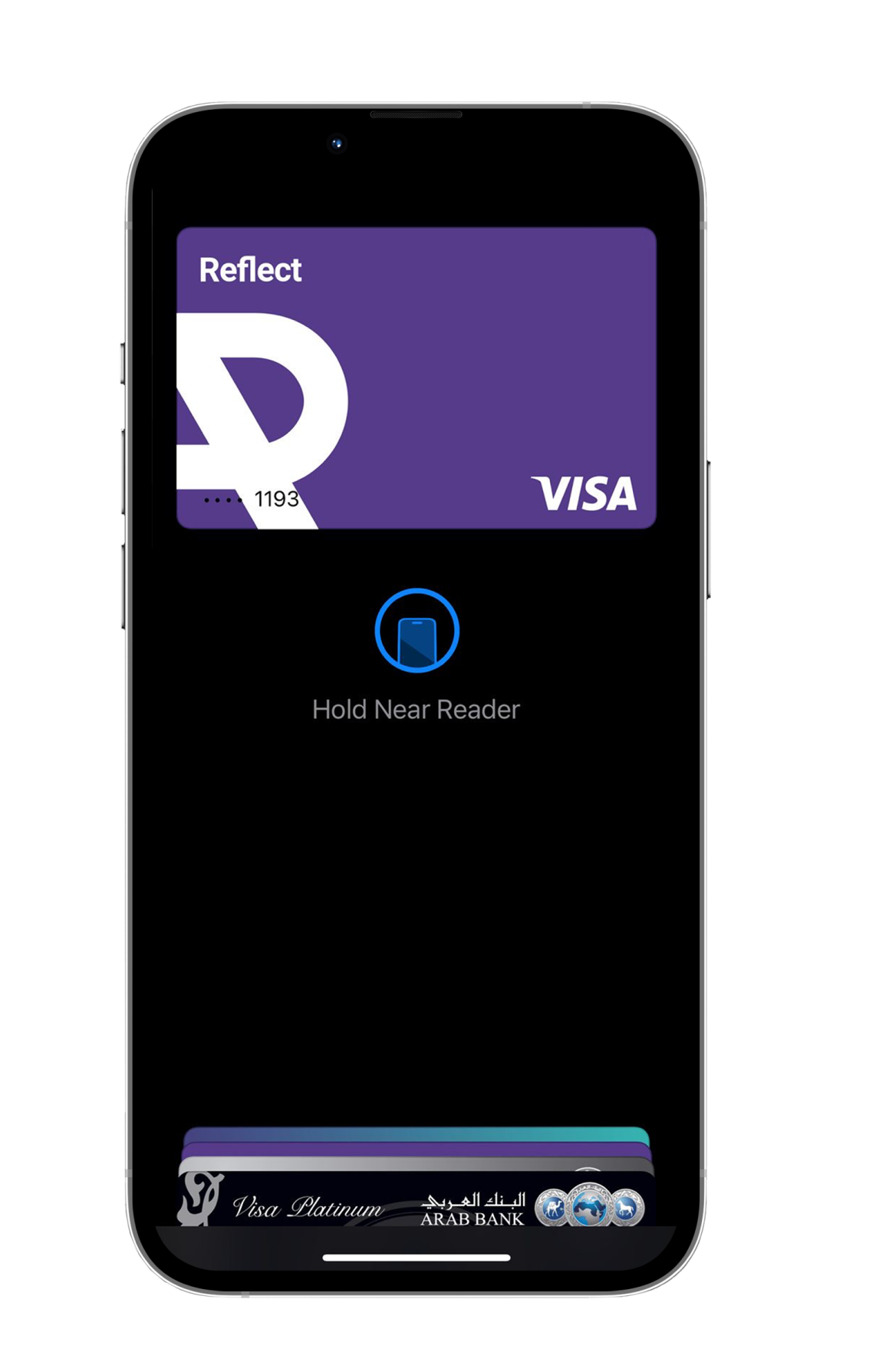

If you transfer your salary to Reflect:

| Salary | Credit Card Limit | Max Limit |

|---|---|---|

| JOD 300- 499 | 1x Salary | JOD 500 |

| JOD 500-699 | 1.5x Salary | JOD 1,000 |

| JOD 700+ | 2x Salary | JOD 3,000 |

** You will be eligible for Reflect Credit Card after 3 months of transferring your salary to Reflect.

Non-Salaried Users:

| Average Account Balance for 3 Months | Credit Card Limit | Max Limit |

|---|---|---|

| JOD 100-700+ | 1x Average Balance | JOD 700 |

** Your average account balance must be 100 JOD every month for a minimum of 3 months to be eligible for Reflect’s Credit Card.

If your salary is transferred to Social Security Corporation:

- Your salary must be JOD 300 or above

- In that case, you will be eligible to 0.5 x your salary up to JOD 1000.

More information:

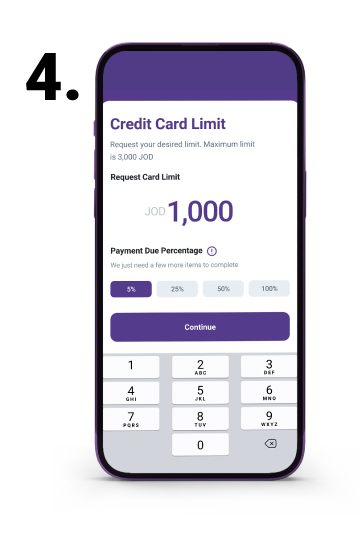

Minimum limit: 100 JOD

Maximum limit: 3000 JOD

Monthly interest: 1.5%

Cash withdrawal fees: 4% with a minimum of 4 JOD.

Late payment fees / Over limit: 5 JOD

Free of annual fees

** Fees may apply for transferring funds from your credit card to your Reflect account.

To apply, you will need:

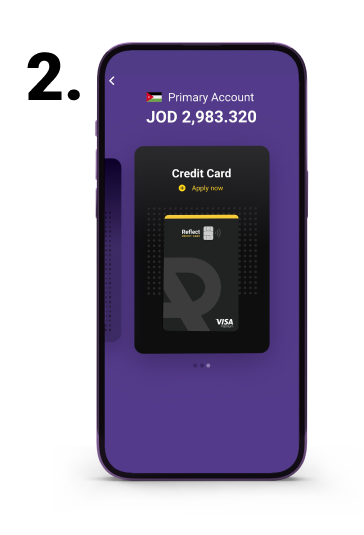

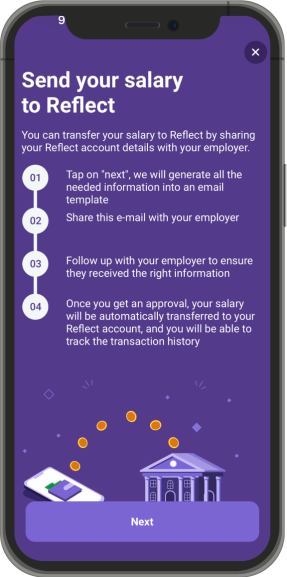

- Choose “Credit Card” from the app homepage.

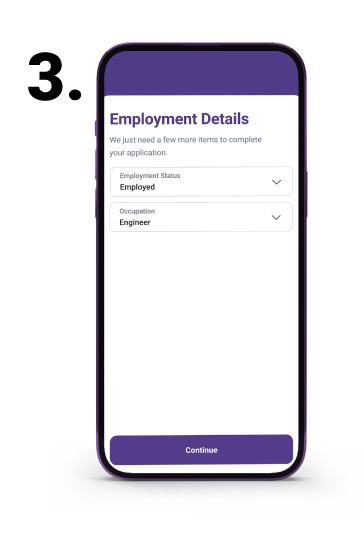

- Confirm your employment status & occupation.

- Input your requested credit card limit & due payment percentage.

- Accept or decline the limit you are eligible for.

- Confirm card delivery & you will receive it during 3-5 business days.

Easy Payment Plan up to 24 months with 0% interest at selected merchant stores

Apply for a Credit Card now

How to order a credit card: