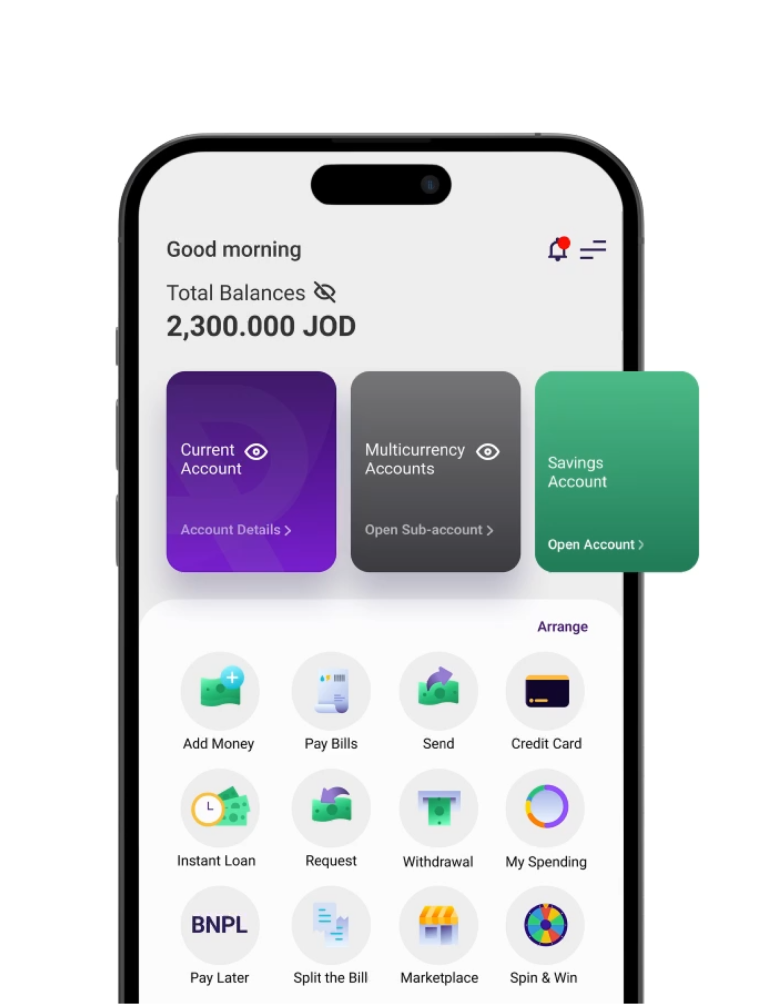

Banking Made Personal

Your financial journey starts here.

Banking Made Personal

Your financial journey starts here.

Unique cards for all your transactions

Unique cards for all your transactions

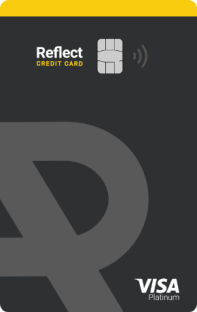

Credit Card

No salary transfer. No paperwork. Apply for your free Visa Platinum Credit Card now!

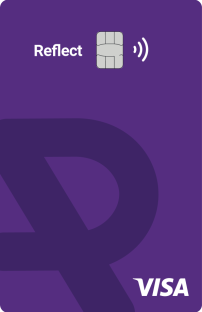

Reflect Card

Shop anywhere offline and online, pay in 6 different currencies, and enjoy offers and cashback with our Visa Debit Card.

Virtual Card

An instantly issued virtual card upon account opening for secure online transactions.

Credit Card

No salary transfer. No paperwork. Apply for your free Visa Platinum Credit Card now!

Reflect Card

Shop anywhere offline and online, pay in 6 different currencies, and enjoy offers and cashback with our Visa Debit Card.

Virtual Card

An instantly issued virtual card upon account opening for secure online transactions.

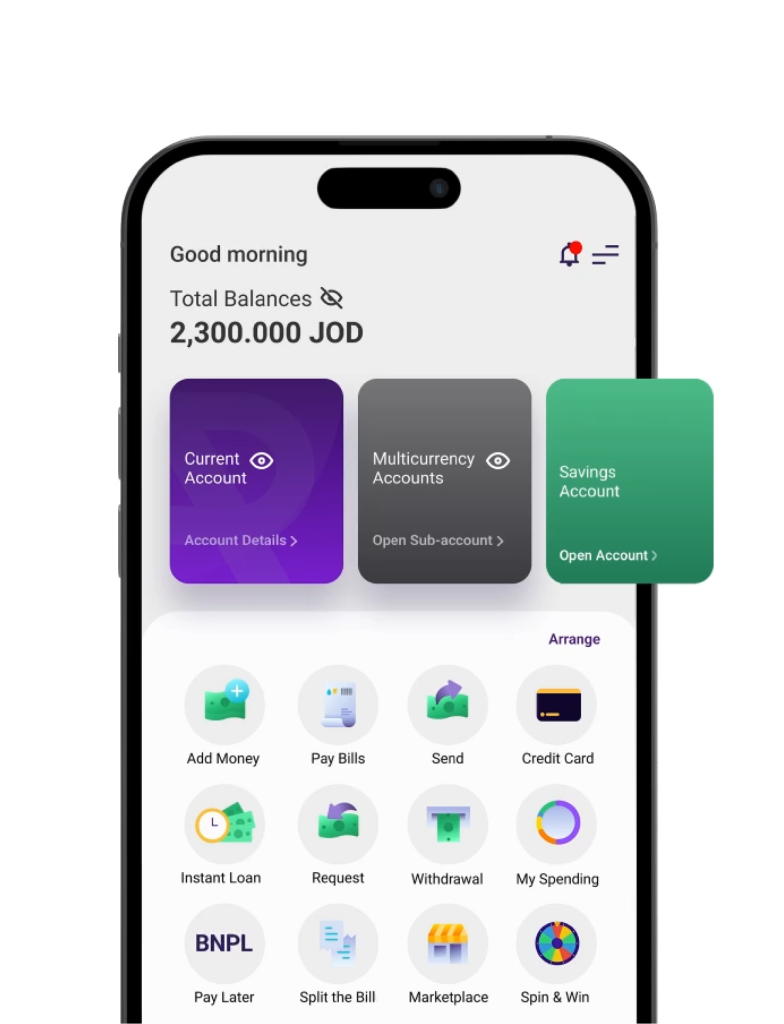

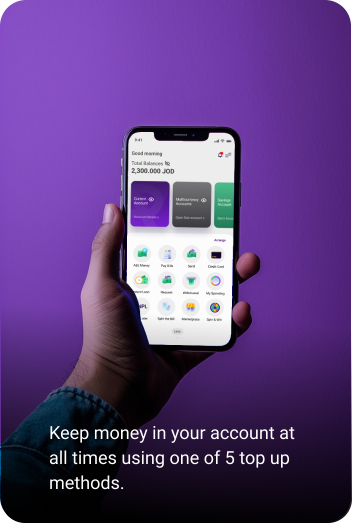

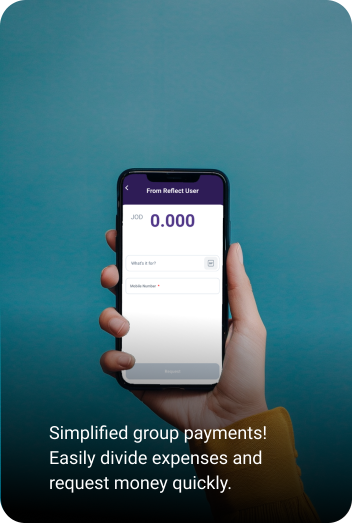

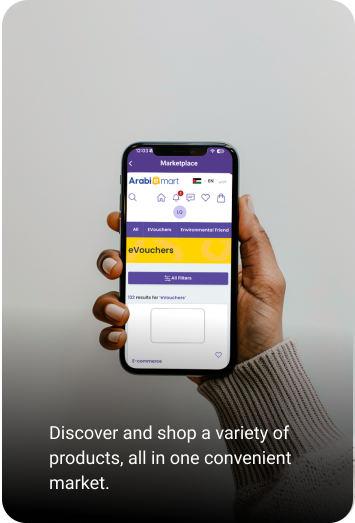

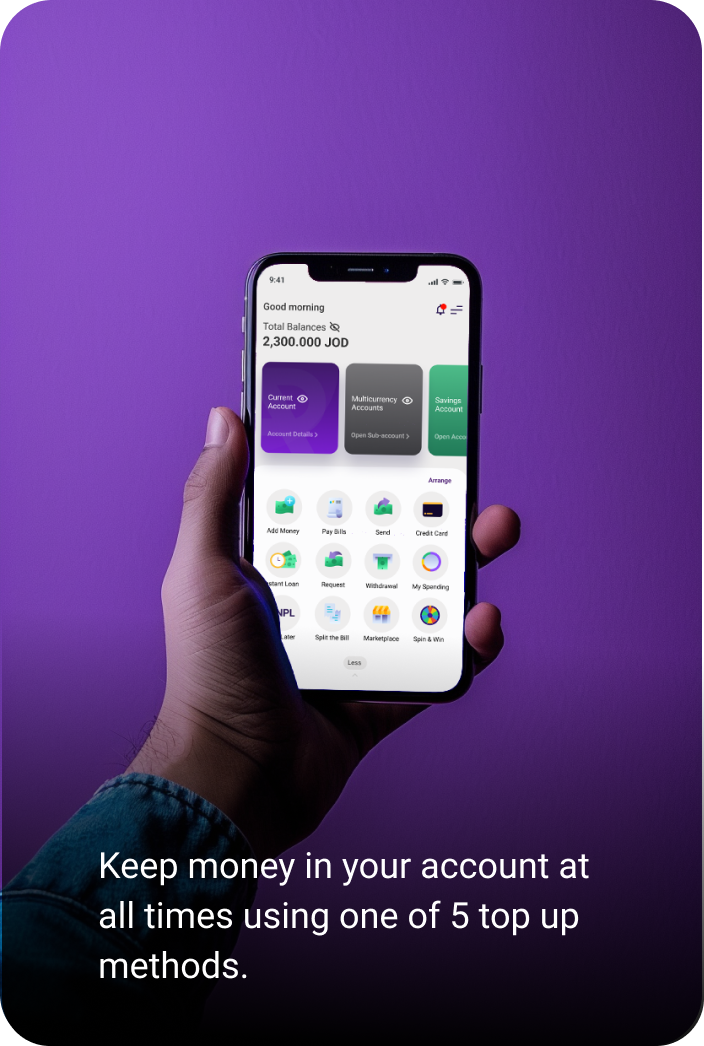

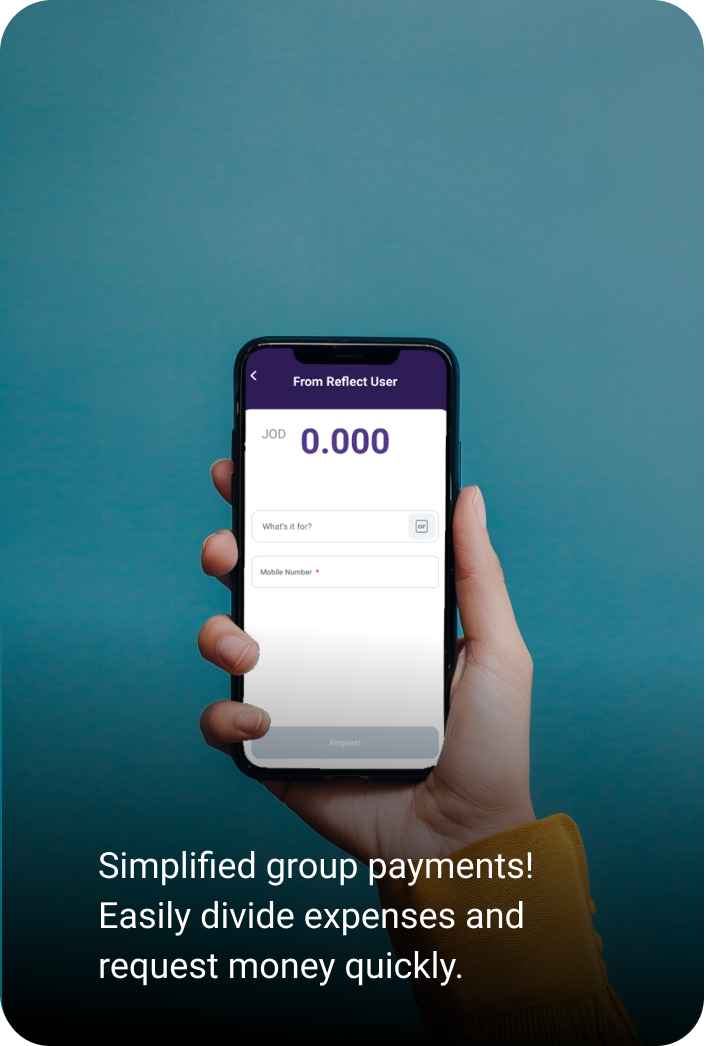

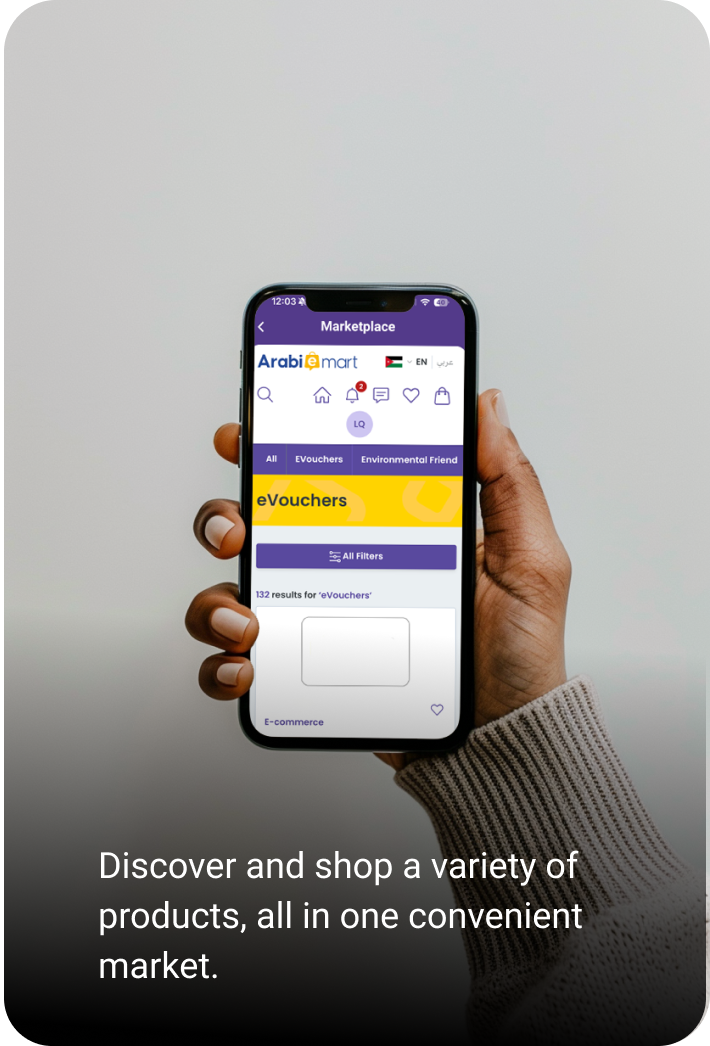

Features you will love!

Benefit from a range of top-notch features & services tailored to elevate your banking experience.

Features you will love!

Benefit from a range of top-notch features & services tailored to elevate your banking experience.

Why Reflect

Frequently Asked Questions

Frequently asked questions & straightforward answers!

Frequently Asked Questions

Frequently asked questions & straightforward answers!

How can I contact Reflect?

You can contact us through email at: support@reflectapp.com or reach out to our support team via WhatsApp on +962792777027

Our support service is available (from 8 am to 12 am from Sunday – Thursday) (And on Saturdays from 9 am to 3 pm).

How to order a credit card?

You will be able to apply for the card fully from the application.

How can I open an account on Reflect?

You can download Reflect app from either App Store, Google Play, or App Gallery. Register within 15 minutes by scanning your national ID, taking a selfie and entering some basic personal information.

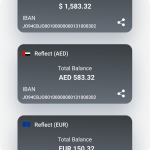

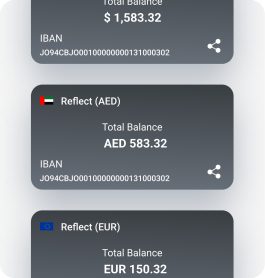

Which currencies are supported for multicurrency accounts?

What is Reflect’s Instant Personal Loan?

Reflect’s Instant Personal Loan is a hassle-free financial solution designed to provide quick access to cash for various needs such as sudden expenses, education, travel, or seizing important opportunities. You can apply to a loan within a 15-minute process through less than 10 simple steps.

What is Reflect?

Reflect is a lifestyle Digital Mobile Banking App that offers financial and non-financial services all in one place. With Reflect, you can open an account digitally and start spending, saving, and managing your money all in one place.

_____________________

How do I withdraw money from my account?

What is Reflect's instant personal loan?

Reflect’s Instant Personal Loan is a hassle-free financial solution designed to provide quick access to cash for various needs such as sudden expenses, education, travel, or seizing important opportunities. You can apply to a loan within a 15-minute process through less than 10 simple steps.

_____________________

How can I open an account on Reflect?

You can download Reflect app from either App Store, Google Play, or App Gallery. Register within 15 minutes by scanning your national ID, taking a selfie and entering some basic personal information.

_____________________

Which currencies are supported for multicurrency accounts?

What is “Pay Later”?

“Pay Later” service is a Buy now pay later service that allows the users to divide purchases into 4 Interest-free payments over a 3 months period.

_____________________

Trending Offers

Enjoy exclusive offers and discounts from a variety of merchants. Stay up to date!

Trending Offers

Enjoy exclusive offers and discounts from a variety of

merchants. Stay up to date!

Download Now!