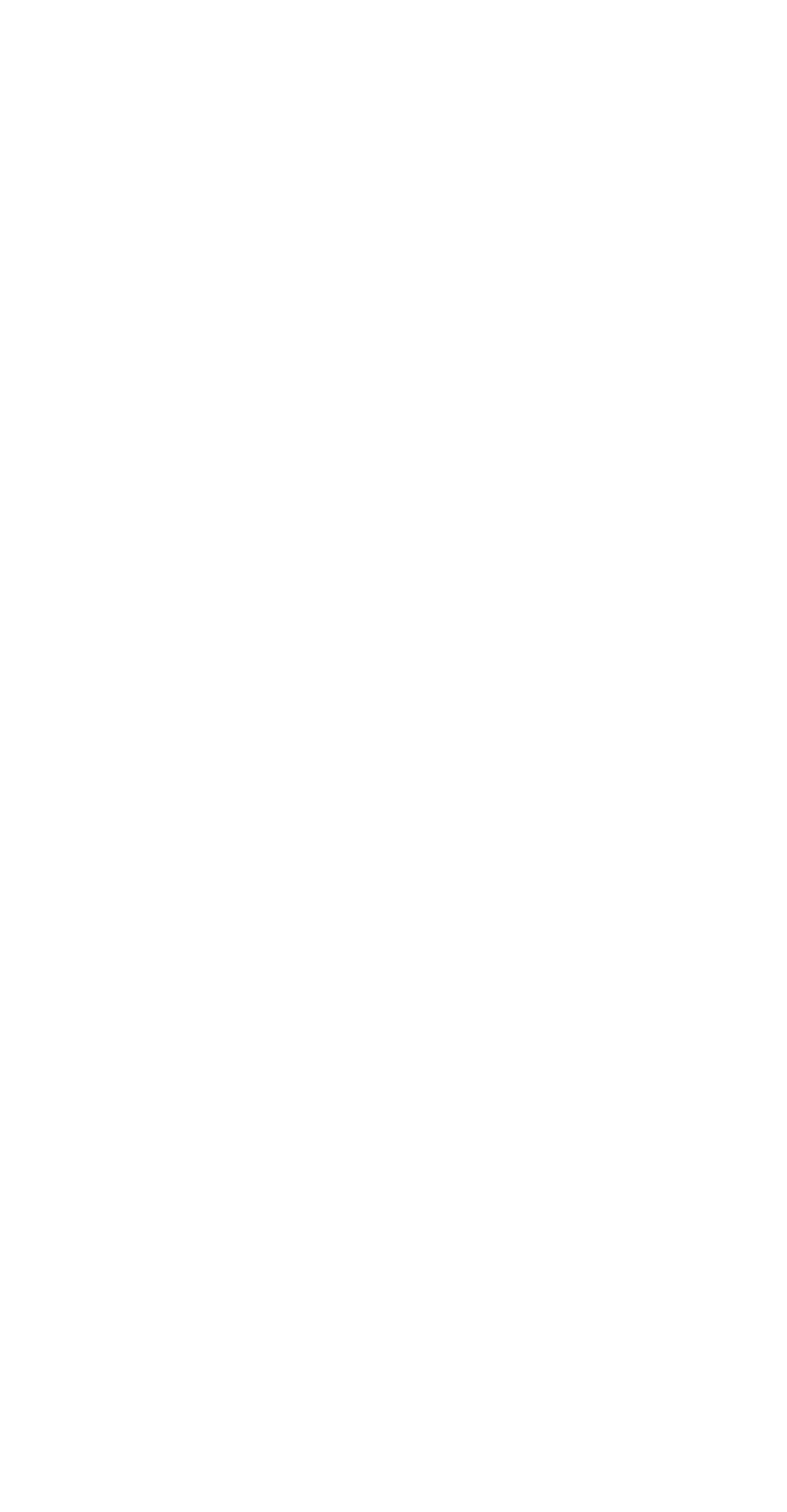

Instant Personal Loan

Unexpected expenses? Education plans? Travel dreams? Reflect has got you covered with Instant Personal Loans! No complicated paperwork, no long waits. Get cash when you need it—fast and hassle-free.

Eligibility Requirements:

To qualify, you must:

✓ Be a Jordanian citizen with a valid ID.

✓ Be between 18 and 65 years old at the time of loan initiation and completion.

✓ Have a monthly salary of at least 300 JOD.

✓ Not have any existing loans with Arab Bank.

✓ Whether you transfer your salary to Reflect or not, you must have your salary registered with the Social Security Corporation.

Here’s how you can apply:

1. Salary Transferred to Reflect:

a. Whether you transfer your salary to Reflect or not, you must have your salary registered to Social Security Corporationb. Salary transferred for 6 consecutive months: Eligible for up to 6,000 JOD.

| Salary Transferred to Reflect | Maximum loan amount in JOD |

|---|---|

| JOD 300 - 999 | Up to JOD 3,000 |

| JOD 1,000+ | Up to JOD 6,000 |

2. Salary transferred to Social Security Corporation:

If your salary is transferred to Social Security, you can apply for a loan of up to 2,000 JOD.

| Salary Transferred to Social Security (Net Salary) | Maximum loan amount in JOD |

|---|---|

| 300+ JOD | Up to 2,000 JOD |

A breakdown of our commissions:

- Granting Commission (one-time fee). 1% of the total loan amount

- Stamp Fees

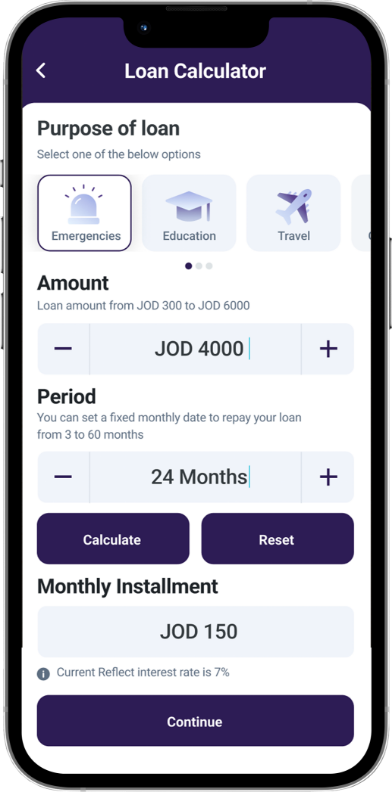

- Early Settlement Commissions: No commission charges for early settlement. (First & only bank in Jordan)

- Past Due Penalties:

- 3 JOD if the overdue amount is less than 70 JOD.

- 8 JOD if the overdue amount is greater than or equal to 70 JOD.

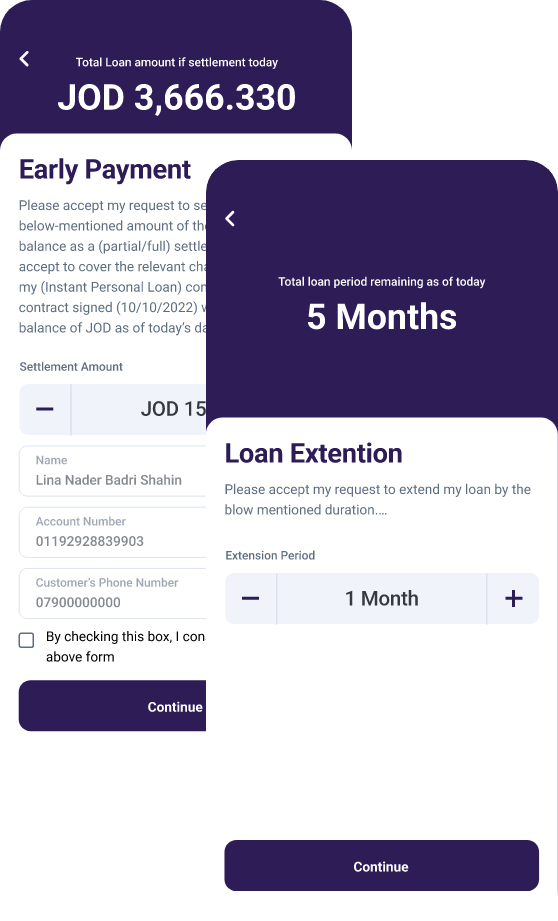

- Re-scheduling Commissions: 5 JOD (Re-scheduling payments are not available in the first year) - Coming Soon!

- Deferment Fee: 5 JOD (Deferment is available in the first year) - Coming Soon!

- Life insurance: 0.5 JOD is debited monthly with each loan payment separately.

** Life insurance is mandatory for all borrowers.

** Governmental stamp duties are imposed on some banking transactions in accordance with the instructions of Ministry of Finance.

How does the collection process work?

- First installment will be due in 30 days from the date of loan disbursement.

- On the due date, we’ll automatically debit the payment amount (partial payments are accepted).

- Subsequent payments will be debited every 30 days.

- Every 30 days, an installment is debited directly from your account.

Delinquency:

- Interest accrues on the closing balance for each late day.

- The equivalent amount of the loan installment value and all interest and commissions will be deducted from your Primary Account or Savings Spaces.