6 Ways to Budget Your Monthly Salary

Budgeting is one of the key aspects that many millennials struggle with. Most individuals end up spending their monthly salaries before end of month, which is due to poor budgeting and financial planning.

Let’s face it; Jordan is an expensive country! Therefore, if you’re not mindful of your expenses, you may easily lose control of your spending. You can avoid overspending each month by creating a reasonable spending budget and sticking to it.

We’ll show you how to create a simple budget in four steps. You’ll need:

- A spreadsheet or an app that helps you budget (Like Reflect)

- Recent information about your income and expenses

- The mindset and will power to make a change!

Start by Calculating your Income

The first step is to know how much money you earn each month. Calculate how much money you earn by adding your salary and other sources of income. This way you have a clear idea of the total sum of money earned on a regular basis. Does the amount you earn change each month? If so, try calculating a minimum monthly income to use in your budget.

Work out Essential Expenditures

The next step is to understand how much money you spend each month. Start by calculating all the essential expenses that you occur each month. These can include rent, car payments, bills, groceries and etc. Knowing the total amount will help you understand the part of your income which you need to set aside.

You can view all your income and expenses in the Reflect app under transactions. The transactions are categorised based on your spending behaviour. You can identify your finances directly from within the app.

With Reflect your transactions are categorised and display merchant names in order to supp

The next step is to figure out if your income covers your expenses? Simply subtract the total monthly expenses from the total monthly income to find out. A negative number means you need to spend less or earn more. You might choose to reduce your spending in the non-essential expenses.

Budget Your Fun Money, too.

Now comes the fun (or not so fun) part, which is checking the amount that you have to trim down for effective financial planning. Shopping, outings, and other non-essential expenses fall under this category. But hold on, that doesn’t mean you can’t have any fun! Set aside an amount each month for entertainment, but make sure to be realistic about it. So don’t set aside 10 JOD when you’re going to spend 50 JOD.

Treat Savings as Living Expenses

In many budgets, the savings category is often overlooked. And In most cases, the amount being saved is the left over amount from all the expenses. The only proven way to take savings seriously is by prioritizing savings and contributing a certain amount to your savings each month. Starting each month set aside a certain amount to save from your non-essential expenses.

Try the 50/30/20 Rule of Thumb for Budgeting

Now that you have an idea of your spending habits and where you can make changes, the 50/30/20 rule can help to manage your money effectively. Using this method, 50% of your budget goes to pay for necessities, 30% or less for wants or things that are not so essential, and 20% or more to savings and investments.

Got Reflect? Boom. You’ve got a budget buddy in your pocket.

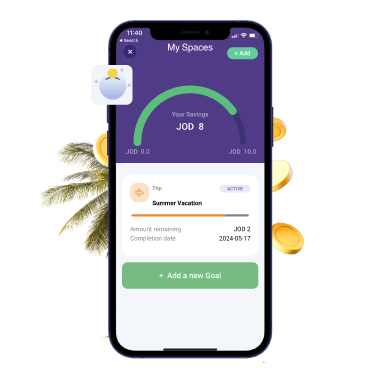

The ‘Saving Spaces’ is a feature in the Reflect App that is super useful if you’re saving for different things as it allows you to set up as many savings spaces as you like. Saving for a house, a vacation, and or something special? Put it in a Saving Space.

Reflect saving spaces are separated from your main balance so that you don’t have to worry about spending any money accidently. Also, there are no limitations to how many spaces you can create, as well as no fixed terms or penalties for pausing or ending a space early.

Now it’s time to set your own budget

No matter how well you plan, budgets only work if you stick to them! Keep an eye on your spending and compare it to your budget regularly.

If the expenses exceed your income, you know something needs adjusting. The opposite is also true sometimes, the amount that you don’t spend should go towards your saving goals.

A good budget will help you spend smarter and identify opportunities to keep more money in your pocket and help you achieve your financial goals.